Understanding 4 Types of Financial Statements

In a subsequent interpretation, the AICPA provided a series of examples of situations to be included or excluded as discontinuances. The company anticipates selling its remaining 16.75% interest for approximately $10,400,000 in interest-bearing notes. Overriding considerations mean both the APB and the FASB require that certain items be reported as extraordinary even though they do not fall within the criteria of APBO 30. On the other hand, an event that the management can control, such as selling an unusual investment, can be deemed extraordinary. The likelihood of a recurring gain or loss from a particular type of event depends on the plans and decisions made by management. This approach would preclude the use of judgments about the classification of an event as operating or non-operating to distort the reported results.

Operating Events

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. After preparing the skeleton of an income statement as such, it can then be integrated into a proper financial model to forecast future performance. After deducting all the above expenses, we finally arrive at the first subtotal on the income statement, Operating Income (also known as EBIT or Earnings Before Interest and Taxes).

Calculate Gross Profit

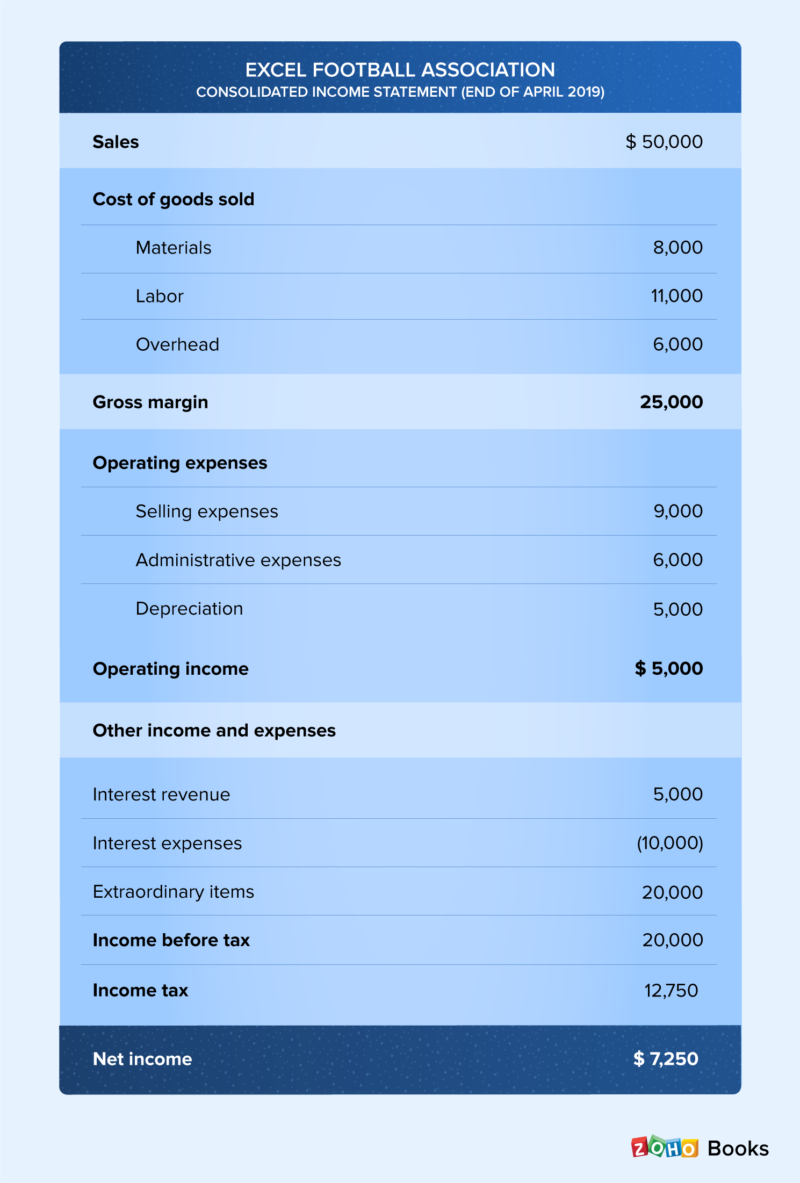

The income statement is an essential financial document that details your company’s income and expenses over a specific period. This document communicates a wealth of information to those reading it—from key executives and stakeholders to investors and employees. Being able to read an income statement is important, but knowing how to generate one is just as critical. When used in conjunction with the other financial statements, an income statement can give you a clear view of your cash flow.

Our Services

“We heard time and again from investors that additional expense detail is fundamental to understanding the performance of an entity and we believe that this standard is a practical way of providing that detail.” The cash flow statement is important because it helps us keep a hold on cash coming and going. Now we know when we will have cash on hand to pay bills or make investments.

Include Income Taxes

When you join PRO Plus, you will receive lifetime access to all of our premium materials, as well as 12 different Certificates of Achievement. After enrolling in a program, you may request a withdrawal with refund (minus a $100 nonrefundable enrollment fee) up until 24 hours after the start of your program. Please review the Program Policies page for more details on refunds and deferrals.

If you have found yourself struggling to find the time to create your own profit and loss report, or P&L, from scratch, a free invoice statement template is the perfect solution. For example, most companies try to keep their Accounts Receivable balance low because it represents future cash, but an increase in this account may be the result of weaker sales. On the other hand, the all-inclusive concept holds that using and comprehending the income statement is more likely if it is the only place where the period’s operating and non-operating events are disclosed.

For example, analyze the trend in sales to forecast sales growth, analyzing the COGS as a percentage of sales to forecast future COGS. Gross Profit Gross profit is calculated by subtracting Cost of Goods Sold (or Cost of Sales) from Sales Revenue. If you subtract all the outgoings from the money the company received, you are left with $21,350. BDO supports the Board’s proposals to refine the derivatives scope exception and to clarify that an entity should apply the guidance in ASC 606 to a share-based payment from a customer as consideration in a revenue contract.

Similarly, an investor might decide to sell an investment to buy into a company meeting or exceeding its goals. In the end, the main purpose of all profit and loss statements is to communicate the profitability and business activities of the company with end users. The income statement calculates the net income of a company by subtracting total expenses from total income. This calculation shows investors and creditors property tax deduction definition the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. When deciding how you’d like to report your net income, it’s important to consider the pros and cons of both single-step and multi-step income statements. Many small businesses need financial statements to apply for credit or to provide financial information to a potential lender.

- Here’s an income statement we’ve created for a hypothetical small business—Coffee Roaster Enterprises Inc., a small hobbyist coffee roastery.

- The income statement describes the income achieved by the reporting entity during a specific accounting period.

- The fact that the survey showed 204 disclosures of extraordinary items in 2018 illustrates the restrictive impact of APBO 30 on practice.

- For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Her Vired offers the Certificate Program in Financial Analysis, Valuation, and Risk Management for someone who’s interested in strengthening their skill set. The learning of these skills in reading financial statements, evaluating a company’s value, and managing financial risks is fundamental knowledge to help you get noticed in the world of finance. A cash flow statement tells us how much cash moves through our business and whether or not we have money for expenses. There is no difference between an income statement and a profit and loss report. FreshBooks accounting software provides an easy-to-follow accounting formula to make sure that you’re calculating the right amounts and creating an accurate income statement.

These are all expenses that go toward a loss-making sale of long-term assets, one-time or any other unusual costs, or expenses toward lawsuits. A business’s cost to continue operating and turning a profit is known as an expense. Some of these expenses may be written off on a tax return if they meet Internal Revenue Service (IRS) guidelines. Payment is usually accounted for in the period when sales are made or services are delivered.

Join over 2 million professionals who advanced their finance careers with 365. Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more. The opinion requires that three items require disclosure in the income statement. The fundamental approach used in the pronouncements sees all gains and losses appear on the income statement. This approach provides details about the causes of changes and their separate impacts in an income statement rather than merely reporting the net change.

There are no comments

Add yours