LIFO Reserve Formula, Calculator and Example LIFO vs FIFO

The use of the term “reserve” in this concept is discouraged, since it implies the recordation of a contra asset against the inventory line item in the balance sheet. In a persistently deflationary environment, it is possible for the LIFO reserve to have a negative balance, which is caused by the LIFO inventory valuation being higher than its FIFO valuation. Adjusted earnings from continuing operations is not a measure of performance under GAAP and should not be considered as a substitute for net earnings, cash flows from operating activities and other income or cash flow statement data. The Company’s definition of adjusted earnings from continuing operations may not be identical to similarly titled measures reported by other companies.

Considerations for Financial Reporting and Shareholders

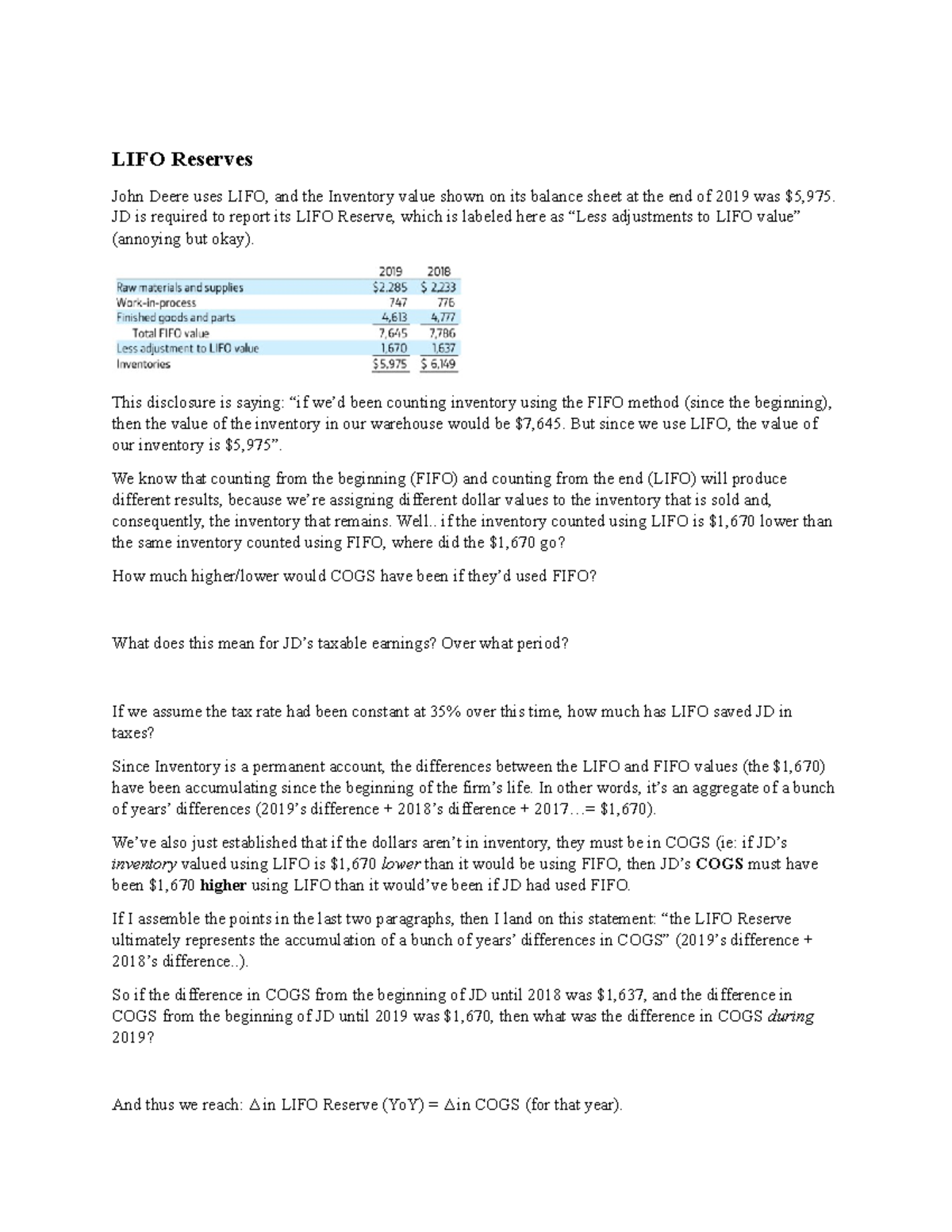

In a deflationary environment, the LIFO reserve will shrink, while the reserve will increase in an inflationary environment. By measuring changes in the size of the LIFO reserve over several periods, you can see the impact of inflation or deflation on a company’s recent inventory purchases. This is also a good measure of the extent to which a company’s reported gross margin is subject to inflationary pressures. With consistently increasing costs (and stable or increasing quantities of inventory items) the balance in the LIFO reserve account will be an ever-increasing credit balance that reduces the company’s FIFO inventory cost. The credit balance in the LIFO reserve reports the difference since the time that LIFO was adopted. The change in the balance during the current year represents the current year’s impact on the cost of goods sold.

LIFO Reserve: Definition, Formula Example, And How Does it Work

- The LIFO reserve should be reviewed on at least a quarterly basis, comparing the current inventory quantities and costs against the base year LIFO inventory levels.

- The LIFO reserve is a ledger account that records the difference between the FIFO and LIFO methods of the inventory report.

- However, any change in the reserve value will be due to changes occurring in the closing inventory calculated using the two methods.

- Given the complex LIFO inventory calculations involved, most companies use accounting software or Excel templates to determine LIFO reserves.

- The measures, when considered in connection with GAAP results, can be used to assess the overall performance of the Company as well as assess the Company’s performance against its peers.

- The balance sheet, income statement, cash flow statement, and other key financial ratios reflect the choice and impact stakeholders’ decisions.

Finance teams need to reverse the LIFO reserve balance through credit entries, impacting earnings. Tracking inventory levels and market cost changes allows for better planning around liquidations. They can also run through multiple scenarios to provide valuable insights into the financial impact of inventory method changes. In summary, a declining LIFO reserve allows companies to gain some temporary benefit from liquidating old inventory in inflationary times.

Accounting Adjustments

It helps in outlining the many differences between using the LIFO method and using the FIFO method. Looking at both the LIFO and FIFO methods, both have advantages and disadvantages and work better under certain conditions. The LIFO reserve is used by a company when it calculates its inventory and cost of goods using the First in First Out method but records it under The Last in Last Out method when doing the inventory report. During LIFO liquidation, the reserve must be adjusted downward to reflect the decrease in old inventory layers.

Journal Entry for LIFO Liquidation

Adjusted Operating expenses were $1.2 billion, an increase of $54 million or 4.6% from the prior year. The LIFO method, on the other hand, is the Last in Last Out technique used to take inventory. This method records a high cost of goods and a low amount of profit made, thus reducing the amount of taxable income. Most companies tend to lean towards using LIFO because it uses their latest inventory to calculate the cost of sold goods. In an inflating economy, this makes the cost of goods sold appear higher than it is. Making the cost of goods sold high reduces the recorded amount of profit along with taxable income.

The FIFO method is applied to internal reports, and often fuels greater profitability. This is more attractive to internal users of the financial statements, such as shareholders, and typically provides a more real or true profit potential of the business. We use Net Debt as a supplemental measure to GAAP measures to review the liquidity of our operations. Net Debt is defined as total debt net of total Cash, cash equivalents and restricted cash remaining on the balance sheet as of the end of the most recent fiscal quarter. We believe that Net Debt is a useful financial metric to assess our ability to pursue business opportunities and investments. Net Debt is not a measure of our liquidity under GAAP and should not be considered as an alternative to Cash Flows Provided by Operations or Cash Flows Used in Financing Activities.

In this post, we will break down what the LIFO reserve is, walk through the formula step-by-step with examples, and discuss the impact it has on your financial statements and ratios. B is incorrect because if inventory unit costs rise and LIFO liquidation occurs, an inventory-related increase, and not decrease, in gross profits will occur. Disclosure of the LIFO reserve equips analysts with the information needed to adjust a company’s cost of sales (or cost of goods sold) and ending inventory balance to the FIFO method based on the LIFO method.

The FIFO method favors a stable or deflating Economy, and the LIFO method favors an inflating economy. The accounting definition of self balancing accounts, however, shows a complete and total picture of a company’s finances (profits, sales, costs, revenue, etc.) in all situations. When investors go through the LIFO reserve, they can both see how much money the company may lose on taxes, and how the actual cost of goods is affecting the inventory value and does a great job in catching an investor’s eye.

There are no comments

Add yours