How to Decrease Retained Earnings With Debit or Credit

Alternately, dividends are cash or stock payments that a company makes to its shareholders out of profits or reserves, typically on a quarterly or annual basis. To find retained earnings, you’ll need to use a formula to calculate the balance in the retained earnings account at the end of an accounting period. Since stock dividends are dividends given in the form of shares in place of cash, these lead adjusting entries to an increased number of shares outstanding for the company.

Retained Earnings Formula: Definition, Formula, and Example

For example, imagine you take out a 10-year loan for $150,000 that you need to pay both principle and interest payments on immediately. Our payments are installments of $10,000, and the first one is $8,000 in principle and $2,000 in interest (amounts made up for simplicity’s sake). Answer the following questions on closing entries and rate your confidence to check your answer. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Debit simply means on the left side of the equation, whereas credit means on the right hand side of the equation as summarized in the table below.

Normal Balance and the Accounting Equation

Since retained earnings are a part of shareholders’ equity, it is an obligation of the company to pay it back to the owners. Thus, it is a liability of the company and it is credited as per the golden rules of accounting for personal accounts. Samsung Inc. earned a net profit of 500,000 during the accounting period is retained earnings a debit or credit balance Jan-Dec 20×1. The company decided to retain the profits for that year and invest the retained earnings in expanding the business.

- The financial flexibility of sole proprietorships allows owners to decide how much profit to reinvest, which directly impacts the growth and expansion potential of the business.

- We need to move the value of the expense from accounts payable into cash when we make the payment.

- A net profit would mean an increase in retained earnings, where a net loss would reduce the retained earnings.

- Retained earnings are usually recorded on the right column of a company’s balance sheet under the equity section along with the company’s share capital and paid-in capital.

- The normal balance of any account is the balance (debit or credit) which you would expect the account have, and is governed by the accounting equation.

Income Statement

Such items include sales revenue, cost of goods sold (COGS), depreciation, and necessary operating expenses. One way to assess how successful a company is in using retained money is to look at a key factor called retained earnings to market value. It is calculated over a period of time (usually a couple of years) and assesses the change in stock price against the net earnings retained by the company. Retained earnings are the portion of a company’s cumulative profit that is held or retained and saved for future use. Retained earnings could be used for funding an expansion or paying dividends to shareholders at a later date. Retained earnings are related to net (as opposed to gross) income because they are the net income amount saved by a company over time.

Understatement of net income

For instance, if a company pays one share as a dividend for each share held by the investors, the price per share will reduce to half because the number of shares will essentially double. Because the company has not created any real value simply by announcing a stock dividend, the per-share market price is adjusted according to the proportion of the stock dividend. Retained earnings refer to the historical profits earned by a company, minus any dividends it paid in the past.

Revenue, net profit, and retained earnings are terms frequently used on a company’s balance sheet, but it’s important to understand their differences. A statement of retained earnings details the changes in a company’s retained earnings balance over a specific period, usually a year. They are a measure of a company’s financial health and they can promote stability and growth. If the company had not retained this money and instead taken an interest-bearing loan, the value generated would have been less due to the outgoing interest payment. Retained earnings offer internally generated capital to finance projects, allowing for efficient value creation by profitable companies. However, note that the above calculation is indicative of the value created with respect to the use of retained earnings only, and it does not indicate the overall value created by the company.

- If a company consistently operates at a loss, it’s possible, though less common, for retained earnings to have a debit balance.

- Retained earnings normal balance is usually a credit, this indicates that the company has generated profits from its inception to the time when the retained earnings balance is checked.

- Companies may pay out either cash or stock dividends, and in the case of cash dividends they result in an outflow of cash and are paid on a per-share basis.

- High-debt companies may retain more earnings to reduce debt and improve financial health.

Financial Accounting

Businesses use this equity to fund expensive asset purchases, add a product line, or buy a competitor. This amount can be used to fund a partnership or merger/acquisition that generates solid business opportunities. Dear auto-entrepreneurs, yes, you too have accounting obligations (albeit lighter!). Find out how this alternative financing method works, with its many advantages. Retained earnings and profits are related concepts, but they’re not exactly the same. If you’re trying to streamline your business, manually logging entries into ledgers or using an Excel spreadsheet is only going to slow you down.

How to Calculate Dividends, Retained Earnings and Statement of Cash Flow

- Although each account has a normal balance in practice it is possible for any account to have either a debit or a credit balance depending on the bookkeeping entries made.

- If a company’s earnings are negative, the company has incurred losses from its operations.

- This can be found in the balance of the previous year, under the shareholder’s equity section on the liability side.

- Hence if a company declares $8,950 in dividends to its shareholders on October 28, 2022, the journal entry to record this dividend payment will be as the one below.

- The specific use of retained earnings depends on the company’s financial goals.

- Negative retained earnings occur if the dividends a company pays out are greater than the amount of its earnings generated since the foundation of the company.

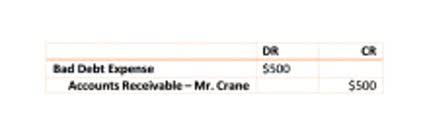

Retained earnings are reported in the shareholders’ equity section of a balance sheet. A maturing company may not have many options or high-return projects for which to use the surplus cash, and it may prefer handing out dividends. The decision to retain earnings or to distribute them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company. If for instance, the company incurred losses of $100,000 the journal entry for the loss will be recorded as shown below. As you can see, retained earnings is only a corresponding entry for the interest part of the loan.

There are no comments

Add yours